Updated by ACWR on August 26, 2020

Stabilize the nonprofit sector to rebuild Ontario

Imagine communities without nonprofits and charities – no summer camps, no minor softball or soccer clubs, no museums, art galleries or theatres, mental health services, women’s shelters, immigrant services, community health centres, food banks, nonprofit housing. Every Ontarian has benefitted from at least one service or program of a nonprofit or charity.

Yet, the sector is at a precarious tipping point. ONN estimates the sector’s economic losses are in the range of $1.8 billion in just the first three months since emergency closures.

Read more

COVID–19: CECRA for small businesses

Canada Emergency Commercial Rent Assistance (CECRA) for small businesses provides relief for small businesses experiencing financial hardship due to COVID-19. It offers unsecured, forgivable loans to eligible commercial property owners to:

- reduce the rent owed by their impacted small business tenants

- meet operating expenses on commercial properties

Property owners must offer a minimum of a 75% rent reduction for the months of April, May and June 2020.

We encourage all eligible commercial property owners to participate in this program.

As part of your application, you must provide rent reduction agreement(s) and landlord and tenant attestations.

Read more

Reopening Safety:

The Event Safety Alliance Reopening Guide:

The Event Safety Alliance® (ESA) is a non-profit organization dedicated to promoting “life safety first” in all phases of event production and activation. They have created and shared a comprehensive reopening guide that helps event organizers through the process of reopening.

You can access the guide here.

BREAKING: DETAILS RELEASED FOR $500M EMERGENCY SUPPORT FUND FROM CANADIAN HERITAGE

Today, the Prime Minister and the Minister of Canadian Heritage, Steven Guilbeault released more details about the $500 Million allocated to Canadian Heritage to address COVID-19’s Impact on the Cultural Sector.

The Emergency Support Fund for Cultural, Heritage and Sport Organizations is an additional temporary relief measure created to help alleviate the financial pressures of cultural hertiage, and sport organizatiosn facing significant losses due to COVID-19 pandemic. The objectives of this fund are:

- to maintain jobs and support business continuity for organizations whose cash flow and short-term operational viability have been negatively impacted by the COVID-19 pandemic; and

- to stabilize a sector that is a major driver of the Canadian economy.

The COVID-19 Emergency Support Fund for Cultural, Heritage and Sport Organizations will be distributed in a two phase approach.

Phase 1:

For funding recipients who are projecting a significant financial impact as a result of the COVID-19 pandemic:

- A formula-based top-up to recipients of the following arts and culture programs: Canada Periodical Fund, Canada Book Fund, Canada Music Fund (via FACTOR and Musicaction), Canada Arts Training Fund, Canada Arts Presentation Fund, Harbourfront Centre Funding Program, and Building Communities Through Arts and Heritage Program.

- Funds to certain Sport Support Program and Athlete Assistance Program eligible recipients as well as formula-based top-ups to the bilateral sport agreements with provinces and territories will ensure funding is disbursed rapidly. Emergency funding will also be available to the Aboriginal Sport Circle and the provincial and territorial Aboriginal Sport Bodies. Existing agreements will allow for efficient and accelerated delivery.

- Funds will also be distributed by the Canada Council for the Arts, the Canada Media Fund and Telefilm Canada to support their recipients. Measures will be in place to avoid any potential duplication of funding between the Department and these organizations.

- Phase 1 also includes support to the April 7, 2020, announcement of the Digital Citizen Initiative’s Digital Citizen Contribution Program to help combat false and misleading COVID-19 information as well as the racism and stigmatization that are often the result.

The streamlined process will use the most recent applications submitted to the program as a basis for topping-up existing funding. Eligible recipients will not have to apply for funding. Existing recipients of targeted programs will be asked to fill out an attestation. Once the attestation has been received and reviewed, funding will flow shortly thereafter.

Phase 2:

As part of the $500 million budget envelope, the second phase will provide temporary support as follows:

- Funding for eligible organizations with heritage collections through the emergency component of the Museums Assistance Program.

- Funding for other organizations, which may include some that do not currently receive funding from Canadian Heritage, the Canada Council for the Arts, the Canada Media Fund and Telefilm Canada (e.g. non-recipient arts and culture organizations, small broadcasters, third-language producers, organizations in live music, local news organizations, magazines and community newspapers).

Further details on Phase 2 will be announced over the coming weeks.

Find out more Here

Ontario Arts Council Survey

Here are the key highlights from the survey:

- The anticipated loss of revenue up to the end of June 2020 due to COVID-19 for these Ontario arts organizations combined totaled $128 million.

- The $128 million anticipated loss of revenues to the end of June due to COVID-19 represents an average loss of 16% of the responding organizations’ total annual revenue.

- Close to three-quarters (71%) of responding organizations confirmed that they will have to take some action relating to staff/personnel decisions by the end of June if the current situation continues – including such actions as laying-off employees, reducing or suspending employee hours, and/or reducing hours or suspending/cancelling contracts of self-employed artists or other independent contractors. A further 21% indicated that it was too early to say whether such actions would be necessary.

- Almost all (94%) of the responding organizations have cancelled or postponed performances, exhibitions, screenings, readings or other events due to COVID-19.

Ontario-Canada Emergency Commercial Rent Assistance Program

The Ontario Government is committing $241 million to partner with the federal government and deliver more than $900 million in urgent relief to small businesses and their landlords through a new program, the Ontario-Canada Emergency Commercial Rent Assistance Program (OCECRA).

The OCECRA will provide forgivable loans to eligible commercial property owners experiencing potential rent shortfalls because their small business tenants have been heavily impacted by the COVID-19 crisis.

How does the program work?

The program has been developed to share the cost between small business tenants and landlords. Small business tenants and landlords would each be asked to pay 25 per cent of the before profit costs and the provincial and federal government would cost share the remaining 50 per cent.

For example, a monthly rent for a small business is $10,000. In this example, assume the landlord doesn’t make a profit. The landlord forgoes $2,500 (25 per cent of rent). The small business would be responsible for paying $2,500 (25 per cent of rent). The government would cover the remaining $5,000, with $3,750 from the federal government (37.5 per cent of rent) and $1,250 (12.5 per cent of rent) from the provincial government.

To receive the loan, property owners will be required to reduce the rental costs of small business tenants for April to June 2020 by at least 75 per cent. The loan would also be contingent on the signing of a rent forgiveness agreement between impacted tenants and landlords. This would also include a moratorium on evictions for three months.

How long would a commercial property owner have to apply for OCECRA?

The OCECRA would be administered by the Canada Mortgage and Housing Corporation (CMHC) and would be available until September 30, 2020. Support would be retroactive to April 1, covering April, May and June 2020.

Are there any eligibility requirements for commercial property owners?

The OCECRA would apply to commercial properties with small business tenants.

Commercial properties with a residential component, and residential mixed-use properties with a 30 per cent commercial component, would be equally eligible for support with respect to their commercial tenants.

The property owner must be the registered owner and landlord of the residential or commercial real estate property.

If a property owner does not have a mortgage secured by a commercial rental property, the property owner should contact CMHC to discuss program options, which may include applying funds against other forms of debt facilities or fixed cost payment obligations (e.g. utilities).

What are the eligibility requirements for small businesses?

An eligible small business tenant is one that:

- Pays monthly rent not exceeding $50,000 in gross rent payments; and is,

- A non-essential small business that has temporarily closed, or who is experiencing a 70 per cent drop in pre-COVID-19 revenues (determined by comparing revenues in April, May or June to the same month in 2019 or alternatively compared to average revenues for January and February 2020).

Not-for-profit organizations and charitable entities would also be considered for the program.

Are commercial properties that also have apartments eligible as well?

Commercial properties with a residential component, and residential mixed-use properties that have a 30 per cent commercial component, would be equally eligible for support with respect to their commercial tenants only.

Does the OCECRA program factor in profits for the commercial property owner through the loan period?

The forgivable loan would be conditional on the property owner and tenant entering into a rent forgiveness agreement (including a moratorium on eviction for three-months) pursuant to which the property owner would reduce the tenant’s monthly rent to 25 per cent of rent that relates to fixed costs for three months. The property owner would be responsible for the remaining 25 per cent. For certainty, government funding, and remaining monthly tenant rent payment obligations (i.e. 25 per cent), would not cover the property owner’s profits derived from rental income – that is, in applying for this program, the property owner agrees to forego profit for a three-month period.

Are any small businesses excluded from the OCECRA program?

The following exclusions would apply:

- Entities owned by individuals holding political office;

- Entities that promote violence, incite hatred or discriminate on the basis of race, national or ethnic origin, color, religion, sex, age or mental or physical disability; and,

- An entity in the Lenders special accounts or Restructuring Group prior to March 1, 2020.

Canada Emergency Business Account (CEBA)

To ensure that small businesses have access to the capital they need to see them through the current challenges, the Government of Canada has launched the new Canada Emergency Business Account, which has been implemented by eligible financial institutions in cooperation with Export Development Canada (EDC).

This $25 billion program provides interest-free loans of up to $40,000 to small businesses and not-for-profits, to help cover their operating costs during a period where their revenues have been temporarily reduced, due to the economic impacts of the COVID-19 virus.

This will better position them to quickly return to providing services to their communities and creating employment.

Repaying the balance of the loan on or before December 31, 2022 will result in loan forgiveness of 25 percent (up to $10,000).

Apply Here

New 2020 OAC Grant Announced!

Arts Response Initiative: Project Grants for Individuals

Purpose

The program supports individual Ontario-based professional artists to continue to work and participate in the arts community in the context of COVID-19. It welcomes practical solutions to current challenges and also encourages exploration, adaptation and the development of new ways of working that will help to increase the resilience of Ontario’s arts sector. Projects must be in response to the challenges resulting from the pandemic. Projects can include activities that assist artists in the short, medium and long term.

Note: This program does not support creation, production, presentation/dissemination or school- and community-based arts engagement activities. These activities are supported through OAC’s regular project programs which continue to run as usual, many with expanded eligibility in response to COVID-19.

Deadline dates

October 20, 2020, 1 p.m. ET

- Applications are available in Nova approximately two months before the deadline.

- Grant notification will be available no later than four months after the deadline.

Important: This program does not provide juror comments or feedback to applicants, whether successful or unsuccessful.

Grant amount(s): Individuals: $4,000

Learn more about Eligibility & Requirements HERE

ONTARIO TRILLIUM FOUNDATION: RESILIENT COMMUNITIES FUND

The Resilient Communities Fund is a one-time fund to support the non-profit sector recover and rebuild from the impacts emerging from COVID-19 so they can effectively meet the needs of communities across Ontario.

OTF is investing in projects of eligible non-profit organizations to aid their medium to longer-term recovery efforts, help with their stabilization and build their capacity and resiliency in the aftermath of COVID-19.

This fund is providing a flexible range of activities over two deadlines to address the diverse needs of organizations and to support them where they are at in their recovery and rebuilding.

Request amount: From $5,000 to $150,000

Grant term: up to 1 year

Application Deadlines*: September 2, 2020 at 5 pm ET. and December 2, 2020 at 5 pm ET.

* Due to the expected high demand and in our efforts to support as many organizations as possible, only one grant per eligible organization will be awarded. Organizations that receive a grant from the September 2nd deadline will not be eligible to apply for the December 2nd deadline.

Click here for more information.

Update from Irene Cheung, Policy Advisor, Office of the Minister of Canadian Heritage

April 17, 2020

The Government of Canada is providing $500 million in 2020-21 to establish a new COVID-19 Emergency Support Fund for Cultural, Heritage and Sport Organizations to help address the complex financial needs of affected organizations within these sectors.

The Fund is meant for organizations that can’t qualify for the existing wage subsidy because of the lumpy or irregular nature of their revenues as well as to cover contract workers. The Fund will also provide advances on future grants and contributions to help maintain liquidity as well as small subsidies to cover some fixed costs.

Eligible organizations and businesses include:

- Canadian not-for-profit cultural, heritage and arts organizations

- National Sports Organizations, Multisport Service Organizations, and Canadian Sport Centres and Institutes

- Canadian journalistic organizations

- Canadian book publishers

- Canadian production companies that work in the film or television industries

- Organizations in the music industry

- Television and radio broadcasters

- Recipients of the Digital Citizen Initiative

Update on CERB, Office of the Minister of Canadian Heritage

Update April 16, 2020

Quick update on the CERB: In his press conference, the Prime Minister said that Minister Guilbeault had brought up the challenges of the arts and cultural sector on access to the CERB, as well as the importance of artists at this time of physical distancing. Here are the key changes:

- There’s no limit on the amount of royalty payments for past works (i.e. those produced by artists before the crisis) that an artist may get while receiving the CERB;

- Someone receiving the CERB may get paid up to $1,000 a month from other sources of income, without penalty or losing their eligibility (and again, royalty payments aren’t included in that category and may be earned on top of the $1,000);

- Someone who wasn’t working when the crisis started, but lost contracts or work that would have otherwise started had it not been for the crisis, can qualify for the CERB. All they need to demonstrate is that before the crisis they would have been working (this is especially helpful to cultural workers who have less work during the winter and many would have only started working again in the spring, which isn’t the case this year);

- People who run out of EI can then switch to the CERB.

WorkInCulture: ARTS & CULTURE MANAGING COVID-19

We want to hear from you…

In the spirit of adapting to change during COVID-19, we want to hear from you about the best ways to support you during this time. In our short survey (we promise, it takes only 2 minutes), let us know your feedback so that we can provide you with relevant resources and programming.

We welcome additional comments and suggestions. If you have any, please send us an email at info@workinculture.ca

Also, don’t forget that throughout April you can post for FREE on the JobBoard and DiscoveryBoard. We will waive the fee for folks and organizations having a hard time due to the crisis. Email us for details.

For more support and financial relief information, please visit our COVID-19 Resources page.

Donate: refunds of tickets/rentals to Arts Organizations

If it is within your means, the ACWR encourages audience members to donate the ticket cost to the organisation instead of requesting a refund. Covid-19 will have an everlasting impact on the cultural industries. If you are in a position, please donate to your local arts organisation. ACWR will post statistics as they are available:

- Over the next six months, across Ontario, the Public Art Galleries will have a conservative total loss up to $13 million. At stake are the small and mid-scale institutions across the 63 communities in Ontario.

- 60% have grave concerns regarding the business continuity of these organizations

- Over 50% Art Service Organizations will struggle to survive. It is expected that 25% will not survive the crisis. This includes community arts councils.

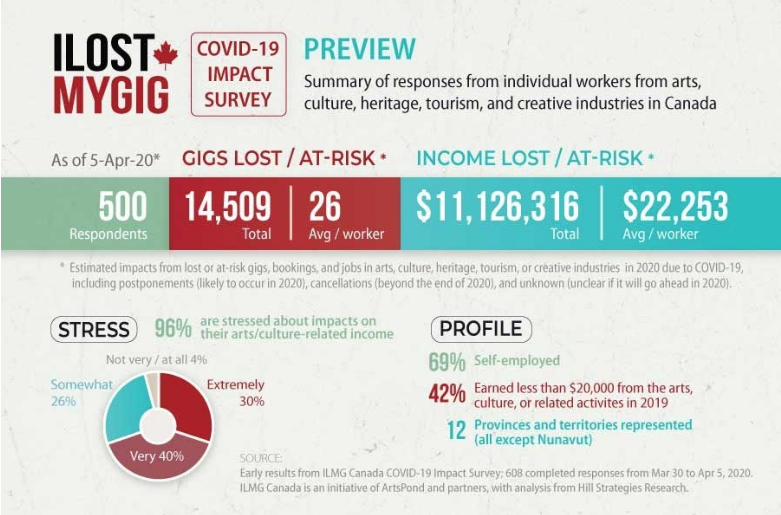

Early Results: I Lost My Gig survey & Documenting Loss Template

Windsor-Essex Artists please fill out our survey: https://ilostmygig.ca It is imperative to have a good data set locally!

Use this template to help artists document your losses: provided by CARFAC & Craft Alliance Atlantic.

April 8th 2020: The Canadian Arts Coalition sent the following update from the office of the Minister of Canadian Heritage on the Canada Emergency Wage Subsidy.

- Businesses/organisations can use January and February as reference points for revenue decline;

- For the month of March, they need to demonstrate a 15% decline in revenue rather than 30%;

- Not-for-profit organisations and charities have the option to include or exclude government funding in the calculations of their revenue loss;

- The wage subsidy is retroactive to March 15, 2020.

The wage subsidy is dependent on negotiations happening between the government and opposition parties on the bill to adopt these measures in the following weeks.

Leadership Emergency Arts Network (LEAN):

LEAN is an immediate, grassroots, pro bono response network to help Canadian professional non-profit arts organizations (big and small) deal with what is coming at them during this crisis. Celia Smith, Jeanne LeSage and Michele Maheux launched this national initiative a few days ago and already have 100 advisers signed on: sector leaders including board members, current and former arts Executive Directors, consultants, etc. from across the country. If you need help at this time in strategic decision-making, crisis response, financial analysis, board direction, relationship mediation, HR management, systems change or inspirational leadership, LEAN ON US! Click here for more info and to sign up: LEAN ORG LINK

From ArtExpert.ca

EN – Support to Arts Managers during the COVID 19 Pandemic – What to do?

FR – COVID-19 : Quoi faire dans votre entreprise culturelle?

Recommended practices for paying artists during the COVID-19 crisis:

This situation has led to many cancellations and we are concerned with the impact on freelance workers, who often live in precarious financial situations. ACWR recommends that all organisations pay out all contracts and if possible move programming online.

Please see all recommendations by the Canadian Artists’ Representation/Le Front des artistes canadiens (CARFAC) the national voice of Canada’s professional visual artists.

ACWR advocates that the artist be paid using the CARFAC fee schedule.

Changes to Canada Summer Jobs program to help businesses and young Canadians affected by COVID-19:

April 8, 2020 – Ottawa, Ontario

The Government of Canada is taking unprecedented action to support workers, businesses, and all Canadians impacted by the COVID-19 pandemic. Right now, young people are facing serious challenges finding work. To build the foundations of strong communities, we need a strong workforce that includes good job opportunities for youth. That is why the government is working to help employers adapt to the realities of COVID-19, and supporting young Canadians as they begin to look for summer employment.

Today, the Prime Minister, Justin Trudeau, announced temporary changes to the Canada Summer Jobs program that will help employers hire summer staff and provide young Canadians access to the jobs they need during this unprecedented time. This program will help create up to 70,000 jobs for youth between 15 and 30 years of age.

Canada’s small businesses increasingly depend on the employment of young Canadians. The changes to the Canada Summer Jobs program will help small businesses hire and keep the workers they need so they can continue to deliver essential services.

The temporary changes to the program for this year include:

- an increase to the wage subsidy, so that private and public sector employers can also receive up to 100 per cent of the provincial or territorial minimum hourly wage for each employee

- an extension to the end date for employment to February 28, 2021

- allowing employers to adapt their projects and job activities to support essential services

- allowing employers to hire staff on a part-time basis

These changes will help youth stay connected to the labour market, save money for their future, and find quality jobs in safe, inclusive, and healthy work environments.

Today’s announcement builds on the government’s action taken for young Canadians during this crisis. This includes a six-month, interest-free moratorium on Canada Student Loans, and a 75 per cent wage subsidy for businesses that will help more employers keep part-time employees and workers over the coming months. Despite these important steps, there is still more to do for students and young Canadians. The Government of Canada will continue to look for ways to support all Canadians, including students and young people, as we weather this pandemic together.

The Canada Summer Jobs program provides opportunities for youth to develop and improve their skills within the not-for-profit, small business, and public sectors, and supports the delivery of key community services. By adapting the program this year, the Government of Canada is making sure that we have the resources needed to support Canadian workers, businesses, and communities dealing with the social and economic impacts of COVID-19.

Heritage, Sport, Tourism and Culture Matter – Here are our next steps dealing with economic impact on Covid19:

Published on April 9, 2020

ByHon. Lisa MacLeod Minister of Heritage, Sport, Tourism and Culture Industries

First, I am announcing almost $100 Million in funding through three programs- Celebrate Ontario, the Ontario Music Fund and the Ontario Trillium Foundation so we can build on that hope for the future.

And as we plan for the future I am again committed to ensuring that:

- $20 Million for over 250 festivals and events in Celebrate Ontario Grants will flow. The list of eligible festivals and events will be listed on the Ministry website during the week of April 20th.

- The Ontario Music Fund has been modernized. Through Ontario Creates they will be administering the $7 Million fund with applications opening in May for 2020-2021. The modernized fund will have three streams:

- Music Creation will support recording and production, marketing and promotion, touring and showcasing and publishing;

- Live Music will support businesses and organizations that produce or promote live music events featuring Canadian artists, including small music festivals and concert series; and

- Industry Initiatives that will support collective industry initiatives to conduct research and analysis, training

- And through the Ontario Trillium Foundation we will flow $67 Million in projects this month so 170 important community projects can proceed with up to three years of support. These investments will help non profit organizations across Ontario deliver services and programs like:

- The Kaleidoscope program, which delivers professional arts experiences for kids in Aurora.

- Programs in Kenora that allow indigenous kids to participate in a local baseball league.

- And the Boys and Girls Clubs across the province that deliver one-on-one mentorship to vulnerable children.

Minister MacLeod’s Town Halls

In March, the Honourable Lisa MacLeod, Minister of Heritage, Sport, Tourism and Culture Industries held a series of telephone town halls to give stakeholders an update on COVID-19 as it applies to ministry stakeholders. Minister MacLeod also took the opportunity to collect real-time information from her ministry partners about the effect COVID-19 is having on them. Click here to listen to past editions, or catch the next Town Hall on April 23.